How to Buy Crypto Currency Using a Credit Card

If you’re new to cryptocurrencies, it can be overwhelming to decide how to buy. There are many different ways to buy crypto currency, and some of them may not be as convenient as others. In this article, we’ll go over how to buy crypto currency using a credit card, use a software wallet, and trade cryptocurrencies. Regardless of which method you choose, you’ll want to take your time and do your research.

Trading cryptocurrencies

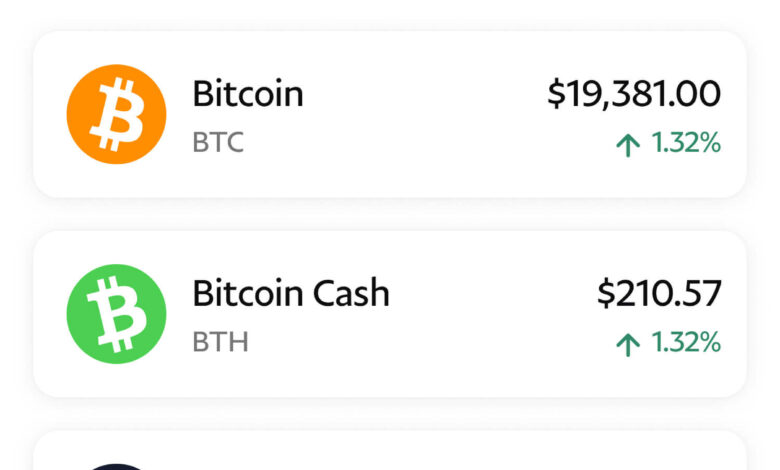

If you’re wondering how to buy cryptocurrencies, you’re not alone. Cryptocurrencies have been generating headlines for years, thanks to an unprecedented rally. There’s even a guide that explains how to buy popular cryptocurrencies. For instance, bitcoin has been the leading digital currency by market capitalization, and in January 2018 it reached a price of $20,000 (from $700).

A good trading platform will give you the latest market news and analysis on cryptocurrencies. Good insight and statistics will guide your decisions and make choosing a particular cryptocurrency a lot easier. Fortunately, there are several trading platforms that cater to the needs of crypto investors. But how do you choose the best one? Here are some things to keep in mind when choosing a broker:

Choosing a good exchange is the first step. There are several options available, and you should choose an exchange that suits your needs and budget. You can start with the most popular ones, such as Coinbase and Gemini. New exchanges are best avoided, but there are some established ones that are worth checking out. To make sure that you get the best price for your investment, choose the trading pairs that suit your needs the most.

While selecting a broker, keep in mind that traditional brokers may charge you for services. However, they’re safer than cryptocurrency exchanges, and the regulatory frameworks governing them are more stringent. Also, if you want to buy cryptocurrency for long-term investment, you’ll want to send the earnings to your own wallet. To make sure you get the best deal, look for a broker with excellent customer support. Some brokers provide customer support in a variety of languages, while others may not.

While buying cryptocurrencies can be intimidating, there are ways to get started. The internet has made it possible to buy cryptocurrencies and exchange them for cash. You can use an online exchange or a local individual. Remember that these services are growing in popularity. It’s a good idea to keep yourself informed on the latest news and trends surrounding cryptocurrencies, and learn as much as you can before making a decision. There are many places to buy cryptocurrency.

Many people are now familiar with the emergence of cryptocurrencies, with the biggest two being Bitcoin and Ethereum. These decentralized currencies operate outside of traditional banking and government regulation. They are a self-regulating system and are regarded worldwide as a trustworthy medium of exchange. Some people even believe that cryptocurrencies are the future of money. However, you should research the risks involved before investing your money. This is why a cryptocurrency exchange is essential.

You can also use an alias email address to purchase cryptocurrencies anonymously. Many online communities have forums and groups devoted to this field, and you can meet people who are looking to buy and sell cryptocurrencies. In this way, you can avoid the pitfalls of dealing with anonymous buyers. The downside of doing business anonymously is that you’ll need to pay in cash, and you’ll need to know someone’s bank account number.

Buying cryptocurrencies with credit cards

Buying cryptocurrencies with credit cards can be a convenient way to buy digital currency. However, many credit card issuers classify such purchases as cash advances, which carry higher interest rates and fees. This means that you can earn rewards for using your card to buy cryptocurrencies, but you won’t get the same benefits of using your credit card for purchases of other goods and services. Buying cryptocurrencies with credit cards is the ultimate example of should vs. can, and the pros and cons of using credit cards for this purpose are very different than those for buying regular cryptocurrencies.

Buying cryptocurrencies with credit cards is possible for many investors. The first step is finding a cryptocurrency exchange that accepts credit card payments. Unfortunately, most popular exchanges do not yet allow this option. Additionally, some exchanges charge a three-5% transaction fee for making cryptocurrency purchases with a credit card. In the end, using your credit card to buy cryptocurrencies is still a viable option for investors who want to make a profit and invest in the cryptocurrency market.

Purchasing cryptocurrencies with credit cards is the most convenient way to invest in crypto. Bank transfers can take three to eight days. Until this processing is completed, your investment won’t go through. This longer process makes it more prone to fraud and gives time for fraudsters to execute exchange hacks. On the other hand, purchasing cryptocurrencies with credit cards is safer and quicker. This way, you can invest in your favorite cryptocurrencies and stay safe in the long run.

Using credit cards to buy cryptocurrency is an increasingly common method of investing in the cryptocurrency market. But it’s important to check with your credit card issuer to make sure that you can use your card to purchase cryptocurrency. It’s worth noting that some card issuers prohibit the use of credit cards for cryptocurrency purchases. Some will block your purchases as a way to protect their customers against losses and fraud. However, many exchanges do not allow credit cards for cryptocurrency purchases.

However, the process of buying cryptocurrencies with credit cards is more complex and uncertain. As with any other form of digital currency, a credit card is an insecure investment. In addition, your credit card will incur interest and fees, so using it for crypto purchases is not recommended. Using a credit card to buy cryptocurrencies with credit cards is a poor idea for most people. Instead, use debit cards, wire transfers or direct deposits to pay for them.

If you don’t want to use your credit card to buy cryptocurrencies, a cash-back credit card could be the best option. This way, you’ll be able to earn rewards while buying cryptocurrencies. Another benefit is that your credit card won’t affect your credit score. By using a credit card to buy crypto, you can also earn rewards for buying bitcoin. This is a smart strategy that can earn you valuable rewards while building your portfolio.

Investing in cryptocurrencies with a software wallet

To invest in cryptocurrencies, you will need a software wallet, a hardware device, or both. A software wallet allows you to store cryptocurrency and keep track of its value. Investing in cryptocurrencies is a risky undertaking, and you will want to invest in something with a high degree of security. Using a software wallet can help prevent the occurrence of hacks and keep your funds safe.

Investing in cryptocurrencies can be risky, especially if you’re not familiar with the market. It’s highly speculative, and the market is very volatile. Although there are many advantages to investing in cryptocurrencies, you should still read up on the subject. Don’t be afraid to ask questions. Read up on the various platforms and make sure that the company has a solid business foundation. Also, make sure to read through the prospectus for the company that offers the services. This can give you peace of mind and a clear picture of the company’s security.

While there are a number of software wallets available, you should be wary of those which store your private keys. These wallets aren’t as secure as software wallets, and they may be susceptible to hacks. A software wallet that is backed by a reputable service and a legitimate exchange will protect your funds and help you invest seamlessly. A custodial wallet, on the other hand, will allow you to maintain your own private keys.

Because cryptocurrency exchanges don’t have any government backing, you are exposed to risks and losses. Because there’s no central regulator to protect your money, it is important to make sure your software wallet has the backing you need. While many crypto wallets claim to provide the best security and privacy, they aren’t the safest way to keep your funds. That’s why a software wallet is an excellent choice for cryptocurrency investors.

To invest in cryptocurrencies, you’ll need a wallet. You can use software wallets or cloud services, and they’re both secure ways to store your cryptocurrency. A software wallet is a great option for active traders, while a hardware wallet is designed for long-term holding. The biggest downside of a hardware wallet is that it can take several hours or even days for you to transfer your crypto out of the wallet.

While many people may think of cryptocurrency as a complex concept, it’s important to remember that it’s a digital currency that runs on a distributed network. A network of thousands of machines processes transactions. By processing these transactions, the machines earn cryptocurrency. A blockchain also creates new coins, or crypto units, as they are translated by computers. So, investing in cryptocurrencies can be a very rewarding endeavor if you know how to use it correctly.

For more valuable information visit the website