What Is My Kohl’s Credit Card?

If you want to get the best discounts possible, consider using the Kohl’s Credit Card. This credit card is not a rewards card, but it does offer coupons. These coupons can save you up to 30% on your purchases. That is twice as good as the 15% discount coupons that you can get without a Kohl’s Credit Card. You can get the coupons through your online account or by mail. You can also sign up for the email updates and receive them via snail mail.

The benefits of the Kohl’s Card can be overwhelming. Although there are many benefits, they are mainly for regular shoppers. If you spend more than $500 at Kohl’s each year, you can expect to get an extra $50 discount on your purchases. The best part is that you can stack these coupons together. You can use this to get even bigger discounts on your pricier purchases. If you don’t plan to use the card frequently, a regular cash-back rewards credit card may be a better choice.

The Kohl’s Credit Card is required to use the coupons you receive in the mail. As long as you pay with your card, you will not earn any rewards on your purchases. You can use a traditional rewards credit card that offers much higher rewards. The Citi(r) Double Cash Card, for example, offers 2% cash back on every purchase. If you don’t plan to use your Kohl’s Credit, consider signing up for the Kohl’s Charge Card.

The Kohl’s Charge card is a closed-loop store card, which means that you can only use it at Kohl’s. Unlike other cards, the Kohl’s Charge card will give you special discounts on special sales or promotions. So, you’ll have to spend a minimum of $600 a year to get a credit line that will cover your purchases. However, if you’re a frequent shopper, you could get the maximum of $5,000.

The Kohl’s Charge card is designed for frequent Kohl’s shoppers. It offers benefits to both the retailer and the customer. The Kohl’s Charge card will allow you to shop online and use the app at Kohl’s. Its app allows you to shop in the store with your mobile phone. Another great feature is that you can use your smartphone to pay for items at the store. This makes the checkout process much quicker.

Read More: What Is Considered Confidential Information?

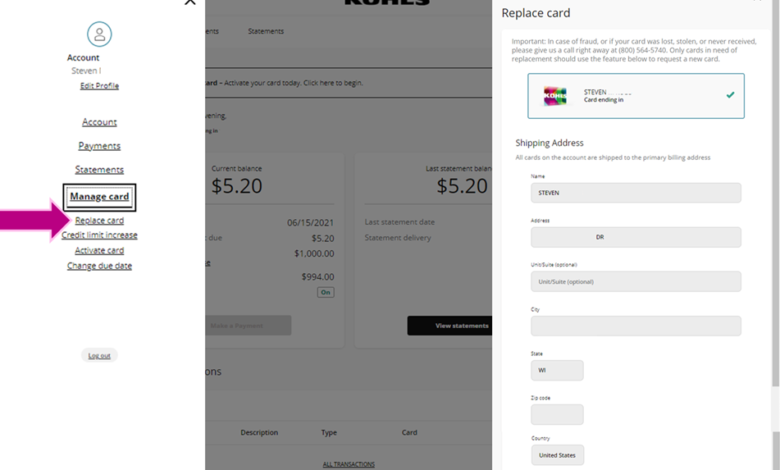

You can apply for the Kohl’s Charge card by visiting the MyKohlsCharge website. The application should not take you more than a few minutes. You can also apply for the Kohl’s Charge card in-store by filling out the form at the Kohl’s Store. It will require the same personal information as the one you filled out online. Once you’ve applied for the Card, you can start using it as soon as you get it.

With the Kohl’s Charge, you can get free shipping every month, and you can also get extra savings coupons for all your purchases. Unlike other credit cards, the Kohl’s Charge card offers special discounts and promotions on every purchase. You can use this card to buy clothing, jewelry, or even home decor. You can even use your Kohl’s Card to pay for your online orders. It’s so convenient! When it comes to using your MyKohl’s charge, it’s hard not to be impressed.

In addition to offering discounts on many products, the Kohl’s Card comes with a credit limit for the store. This limit is lower than the credit limit you have on your regular credit card. The credit limit may vary from $300 to $3,000 depending on your overall financial status. However, the credit limit is typically lower than $1,000 for most people. The store credit limit is different for your card than your credit rating. If you have a good credit history, you should be able to pay off the balance of your Kohl’s credit card online.

Your Kohl’s Credit Card has a store credit limit. This limit is usually lower than your normal credit limit. This limit is determined by your credit standing. For most people, the credit limit on a Kohl’s Card is below $1,000. When using your Kohl’s Credit Card in the store, make sure to remember that you will have to provide a receipt. In most cases, the store will ask for this information to validate the purchase.

For more valuable information visit the website