Why Crypto Portfolio?

Financing in cryptocurrencies is a very famous method of making money in today’s world. Many individuals have possibly heard about the presence of such tokens as, for instance, Ethereum or Bitcoin. Some of them attempted to earn money on this. Some people did it, some people didn’t. Unfortunately, today some individuals know how to properly fund in crypto. The outcome of this type of asset is often very unfortunate – the only currency at some point starts to rapidly fall in value, and individuals try to get divested of the unprofitable investment quicker. As an outcome – the loss of part of the investments and complete dissatisfaction in this field.

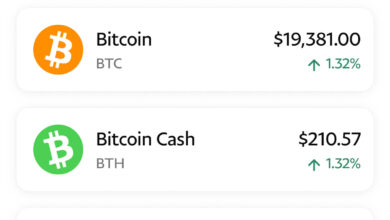

Nevertheless, if it is conceivable to hover over the funding procedure, then you can earn a satisfactory amount of money in this field. One of the most influential methods is to develop the best crypto portfolio and track it with the tools like CoinTrack AI.

Why is it a smart move?

Here is a real instance. A person preserves money in a bank. With a high degree of possibility, he will decide not on one currency (for instance, the euro), but many (for instance, euro, dollar, and the British pound) in a specific ratio. In the event of an unexpected decrease in one of them, a boost in the value of others will help to pay back for losses and even stand in the black. The same strategy devotes to cryptocurrencies. Focusing on only one currency, you can simply lose everything at one time. By ideally modifying your crypto portfolio, you can decrease the threat.

As part of this material, we will let you know how to develop the best crypto portfolio and give a couple of instances for better understanding.

- Coin utility

One of the most essential factors when selecting a cryptocurrency is the need for users in daily life. If it is frequently used in computations, there are smart agreements that have demonstrated themselves in practice, then you can securely take it. For instance, Bitcoin is used as payment in some European restaurants and cafes. Ethereum, in turn, allows creators to develop decentralized apps (DApps) relying on their blockchain.

- Trading volume

Trading volume most apparently demonstrates how much a coin is utilized. Detailed data can be achieved on the traditional resource coin estimation. If the figure is increasing gradually day by day, then we can safely talk about the possibility of raising the coin’s price shortly.

- Crypto correlation coefficient

Cryptocurrencies to some extent relate to each other. For clarity, connection with Bitcoin is generally used. Some rely on “digital gold” to a higher extent, some less. If some coins possess a high correlation coefficient with Bitcoin (for instance, about +1), then it is ideal to restrict yourself to one of them. Otherwise, the failure of Bitcoin may lead to a downfall in the cost of others.

Best crypto tax software in India

CryptoPrep: It is one of the best crypto tax software India. Confidently managing your crypto taxes requires a trusted leader in tax. Organizing your crypto taxes is difficult, but with EY CryptoPrep, your taxes are computed with institutional-grade techniques.

Read More: Lousa Babi