Tax Overpayment: Are You Paying Too Much Tax?

As many as ten million people overpaid on their taxes in 2020. Tax overpayment can happen due to a range of causes. The most common culprit is setting a withholding rate that’s too low.

Many people don’t even realize they’re paying too little. On the reverse side, many people are left wondering why they owe so much on taxes. Again, an incorrect withholding rate can be to blame, among other things.

Are you wondering whether you’ve overpaid or underpaid your taxes throughout the year? Continue reading to learn how you can tell. Also, learn what can be done about it if you have accidentally overpaid or underpaid.

Look At Your Refund

Many people look forward to their refund at the end of each tax season. Getting back a small to moderate-sized refund isn’t cause for concern. If you’re getting back thousands of dollars year after year, however, this is a big warning sign you’re paying too much tax.

Sometimes big refunds happen because there was a significant life change at some point during the year. For example, having a baby, buying a home, changing jobs, or gaining full custody of a child could alter your refund significantly. Generally, these would only increase your refund for a single tax year.

Look At How Much You Owe

On the opposite end of the spectrum, finding out you owe the IRS a significant amount at the end of the year also signals a problem. It isn’t rare to owe the IRS up to a few hundred (although this can also be fixed). If you owe $500 or more at the end of each year, however, there’s an error somewhere.

Owing the IRS a lot after filing your taxes usually amounts to one of two things. First, you may have failed to claim a deduction you were entitled to. Second, you may be paying avoidable penalties like late filing fees.

How To Fix the Problem

To fix either problem above, there are two simple options.

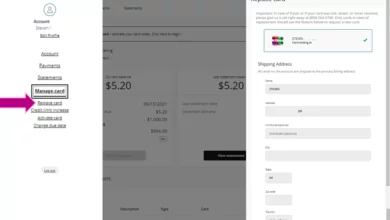

If you find that you’re overpaying or underpaying significantly, you may need to adjust your withholding rate. If you’re receiving a large refund, you should claim a higher withholding rate. If you owe a lot at the end of the year, you should claim a lower withholding rate.

Another option is to hire a tax professional or accountant to help. This is a more secure option than the one mentioned above because it ensures the issue will be fixed no matter what it is. You can find an example of professionals to hire at WealthAbility Linked in.

More Questions About Tax Overpayment?

Many people overpay their taxes throughout the year and don’t even realize it. Conversely, others underpay taxes or owe way too much and don’t understand why. The information above can help you determine if one of these situations applies to you, as well as what you can do about it.

Do you have more questions about tax overpayment?

Check out our other blogs. You’ll find posts on taxes, finances, and related topics to help you dive further into the matter.